Want free tax filing in 2025? You really can file your taxes for $0 this year—no tricks, just the right tools. For instance, Sarah, a freelancer, saved $150 last year using cost-free tools. With these three secrets, you can navigate tax forms and avoid sneaky fees like a pro. From IRS programs to open-source solutions, this guide shows the smartest no-cost moves for tax filing. We’ve rounded up the best ways to avoid tax filing fees in 2025 so your return stays $0. For the bigger picture, see our broader guide to frugal living. If you love collecting frugal living freebies, keep that page bookmarked.

Find Your Free Tax Filing Option Now!Table of Contents

- Key Takeaways to Avoid Tax Filing Fees (2025)

- Why Free Tax Filing Matters

- IRS Free File: How to File for $0 in 2025

- Avoid Hidden Fees When Filing Free (2025)

- Open-Source Tools to File Taxes for Free

- Free Tax Preparation Help in 2025

- Interactive Tool: Find Your Free Tax Filing Option

- Money-Saving Tips for Free Tax Filing (2025)

- Frequently Asked Questions

- Conclusion: Your Plan for $0 Tax Filing in 2025

Key Takeaways to Avoid Tax Filing Fees (2025)

- ✅ IRS Free File Leads the Way: Use trusted tax software for free through the IRS Free File program (guided for eligible AGIs; fillable forms for all income levels).

- 🛡️ Steer Clear of Fees: Avoid traps like refund-based processing and pricey add-ons.

- 🌐 Open-Source Solutions: Leverage free, transparent tax software for zero-cost filing.

- 🧐 Verify Eligibility: Ensure you meet income or other criteria for free tax tools.

- 📝 Pay Upfront: Opt for direct payments to avoid deductions from your refund.

- 🧰 IRS Direct File (2025): If available in your state, you can file federal taxes directly with the IRS at IRS Direct File.

Why Free Tax Filing Matters

The good news? You can use no-cost filing options in 2025 and keep tax prep costs at zero. Tools like IRS Free File, volunteer programs, and open-source software keep filing affordable and less stressful. Jane, a part-time teacher, saved $200 with the VITA program and put it toward unexpected medical bills. Mark, a college student, used IRS Free File, saved about $100, and bought textbooks. Filing for free saves money and gives you peace of mind. Use the steps below to turn tax season into a simple, budget-friendly win—without paying for software. For more ways to stretch your budget, see our Grocery Shop Save Money: 15 Smart Strategies That Work. Let’s dig in and pick the tools that fit you.

IRS Free File: How to File for $0 in 2025

If you want to file your federal taxes for $0, IRS Free File is one of the easiest paths in 2025. It partners with major tax software companies and gives you two ways to file. In 2024, about 2.9 million returns were filed through the program—money that stayed with taxpayers instead of prep fees. Whether you’re juggling gig work, living on a fixed income, or watching a student budget, it’s designed to stay simple and accurate. Here’s how to use these tools—step by step—so you actually save.

Guided Tax Software for a Stress-Free 2025

New to taxes or just want fewer decisions? The guided software asks plain-English questions and fills in the forms for you (generally for AGI up to $84,000). It’s a straightforward way to get your refund without sweating the details.

Free File Fillable Forms

Comfortable with forms? IRS Free File’s fillable forms work like the paper versions—only faster—and they’re free for everyone. Confident filers who want full control tend to like this route for 2025.

Steps to Access Free Filing

- Go to IRS.gov.

- Search IRS Free File.

- Open Free File: Do Your Taxes for Free.

- Review the participating providers.

- Pick one that matches your income and situation.

- Start the free return from the IRS portal link.

Quick link: IRS Free File – official IRS page

Maximizing IRS Free File (Keep It $0)

- Check Income Limits: Providers’ AGI thresholds vary, so review carefully.

- State Filing: Some include free state filing; others may charge.

- Use the Portal: Access software via IRS.gov to avoid fees.

- Read Terms: Understand conditions to make sure your free filing stays free.

- File Early: Start early to take full advantage of free tax tools in 2025.

Avoid Hidden Fees When Filing Free (2025)

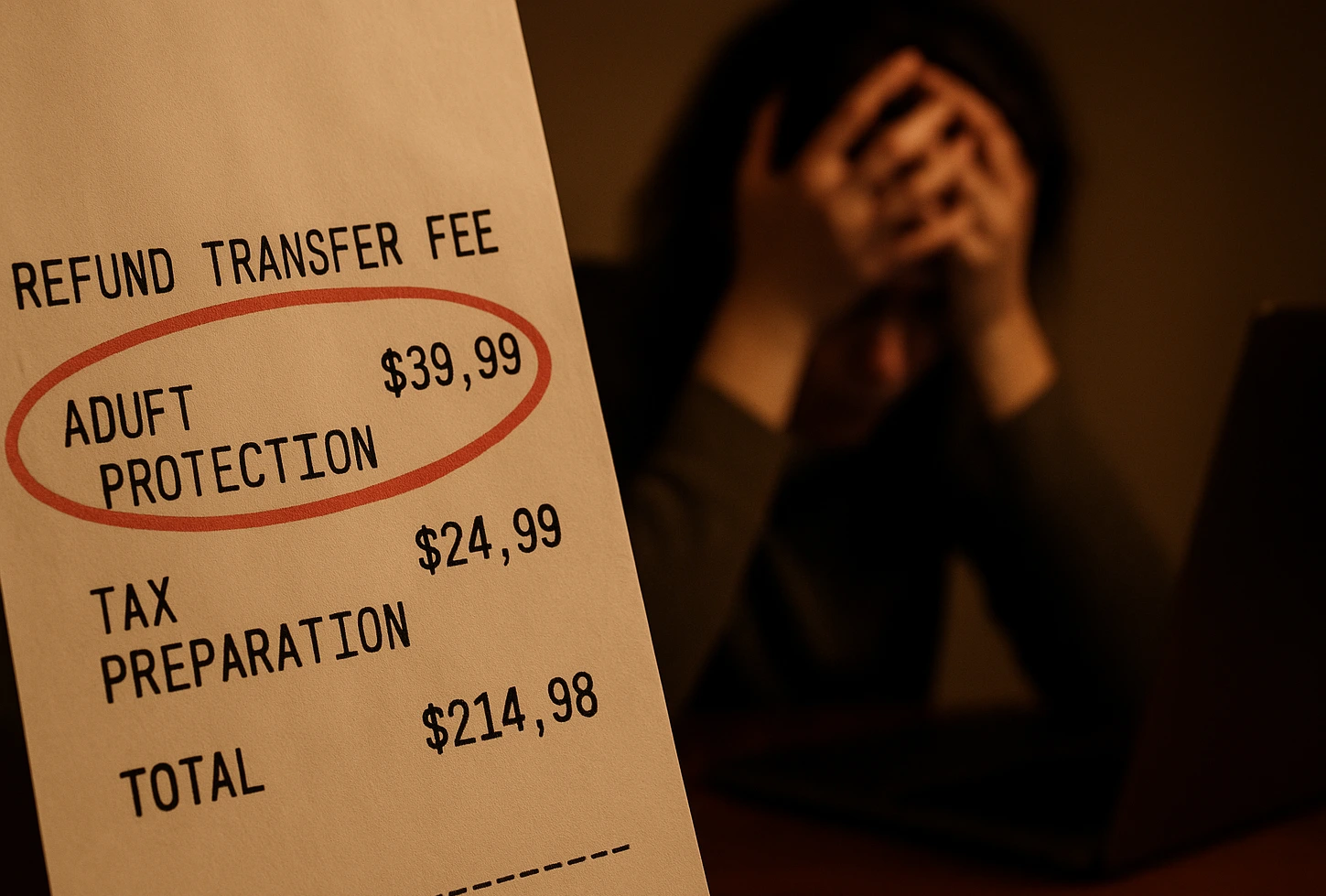

Hidden fees can sneak up and ruin your plan to file for free. Some filers get hit with around $40–$45 in refund transfer/processing fees when they choose to have software costs taken from their refund. A few smart checks—like using the IRS portal and skipping upsells—help you keep 2025 filing costs at $0. Watch for trials labeled “free” that later charge to e-file or bundle pricey add-ons. Lisa learned this the hard way—her “free” return ended with a $50 e-file charge. Look closely at the payment screen, skip refund advances, and say no to extras like audit protection unless you really need them. That way, your 2025 return stays free—no surprise add-ons. For more ways to avoid overspending, explore our Frugal Meal Planning: Eat Well for $50/Week to save on everyday expenses.

Quick tip: When in doubt, pay filing costs upfront with a card—this avoids refund-based processing fees and surprise bank charges.

Steering Clear of Refund Fees

- Pay Upfront: Use a credit or debit card to avoid refund deductions.

- Switch Providers: Choose software with transparent pricing.

- Scrutinize Terms: Read payment options carefully.

- Avoid Refund Advances: These loans often carry high fees.

- Understand Transfers: Refund transfers may involve bank or cashing fees.

Other Fee Traps to Watch

Upgrade prompts—Only upgrade if you need extra features. Add-ons—Skip audit defense or identity protection unless essential. State fees—Confirm state filing costs upfront. Choosing refund-based disbursements can add bank/card fees on top of software costs—read every fee screen slowly.

Open-Source Tools to File Taxes for Free

Comfortable with a little setup? Open-source projects such as OpenTaxSolver (maintained by volunteers) let you file for free and see exactly how the math is done. They’re great for people who like transparent, community-built tools and don’t need a polished interface. Before you start, confirm the 2025 updates are live. Alex, a programmer, saved about $120 last year with OpenTaxSolver after checking it matched current rules. It’s one more way to save during tax season.

Benefits of Open-Source Software

- Zero Cost: Download and use for free.

- Transparency: Public code ensures accuracy and security.

- Community Support: Volunteers provide help via forums.

Challenges to Consider

- Technical Skills: May require setup knowledge.

- Fewer Features: Less polished than commercial options.

- Updates: Confirm alignment with 2025 tax laws.

Finding Reliable Open-Source Tools

Look on SourceForge for OpenTaxSolver and similar projects. Some states also provide their own systems (for example, MyTax Illinois). Whatever you choose, verify the project’s reputation and security so your 2025 tax tools stay safe and effective. For additional tech-savvy savings, consider our frugal cleaning hacks to cut costs on household supplies.

Free Tax Preparation Help in 2025

Prefer help from a person? Many programs prepare returns for free if you qualify—solid no-cost options for 2025. If you like face-to-face help or your return is confusing, these services can make a big difference. Susan, a retiree, used AARP Tax-Aide to sort through pension income and avoided about $250 in prep fees. Beyond the savings, the guidance is reassuring. Here’s where to start—and if you’re raising a family, our budget-friendly tips for frugal living with kids can help you save elsewhere too.

VITA Program for Low-Income Filers

The Volunteer Income Tax Assistance (VITA) program helps people who generally make $67,000 or less, people with disabilities, and those who need help with English—at community locations like libraries and centers.

TCE for Seniors

Tax Counseling for the Elderly (TCE) supports seniors 60 and up, tackling tax issues like pensions and retirement income.

AARP Tax-Aide for All Ages

AARP Foundation Tax-Aide is available to anyone, free of charge, with a focus on older adults and low-to-moderate income; no membership required.

Locating Free Tax Help

- Use the IRS VITA/TCE site locator.

- Use AARP’s Tax-Aide locator.

- Contact local community or senior centers.

Need help deciding? If Direct File is available in your state, it can be the fastest $0 option for simple returns; otherwise, start at IRS Free File or VITA/TCE.

Stretch your refund the smart way: Set aside a portion of any refund for essentials—groceries, utilities, and an emergency cushion. Small, planned moves now prevent surprise fees later.

Interactive Tool: Find Your Free Tax Filing Option

Wondering which no-cost filing route fits you best? Answer two quick questions below to get a simple recommendation for $0 filing.

Move the slider and choose a comfort level to see your recommendation.

Money-Saving Tips for Free Tax Filing (2025)

Here are simple ways to avoid tax filing fees this year.

Want to squeeze the most from free filing this year? Try these quick wins:

- Start early — beat the rush and secure the free options before deadlines.

- Check eligibility — confirm you meet the income or other rules.

- Stick to trusted sources — use IRS.gov or well-known platforms for software and help.

- Stay Organized: Got receipts or tax docs? Keep them handy to zip through filing and snag your full refund without a hitch.

- Get Help When Needed: If deductions feel like a puzzle, chat with VITA or AARP volunteers—they’re pros at helping you file for free.

Frequently Asked Questions

Start with IRS Free File for $0 federal filing, then consider OpenTaxSolver if you like full control. Prefer hands-on help? VITA, TCE, and AARP Tax-Aide prep returns at no cost if you qualify. Pick the path that matches your income and comfort level so filing stays simple—and free.

Avoid hidden fees by paying upfront, accessing software via IRS.gov, declining unnecessary add-ons, and steering clear of refund advances or transfers. Always read the terms carefully so you know exactly what you’re agreeing to.

IRS Free File offers guided software for filers with an AGI of about $84,000 or less (check IRS.gov for current details), plus Free File Fillable Forms for all income levels. Review provider-specific criteria on IRS.gov.

Open-source software like OpenTaxSolver is safe if sourced from reputable platforms like SourceForge and updated for 2025 tax laws. Verify reliability and security before use.

Find free help through VITA (for incomes generally $67,000 or less), TCE (for seniors 60+), or AARP Tax-Aide (for low-to-moderate incomes). Visit IRS.gov or AARP’s locator for sites near you.

Some IRS Free File providers offer free state tax filing, but others may charge. Check each provider’s terms on IRS.gov to confirm if state filing is included for your situation.

Conclusion: Your Plan for $0 Tax Filing in 2025

Use these steps to avoid tax filing fees with confidence. Here’s the scoop: filing your taxes for free in 2025 is totally doable, and you’ll keep every cent of your refund. With tools like IRS Free File, open-source options like OpenTaxSolver, and free prep programs like VITA, tax season won’t drain your wallet. Get a head start, double-check your options, and breeze through with a smile.

To explore frugal living more deeply, head over to our main guide on frugal living.

Info only — not tax or financial advice. Rules, income limits, and availability (e.g., IRS Free File, Direct File, VITA/TCE) change. Always verify details on IRS.gov or with a certified professional before you file.

This blog post is for informational purposes only and does not constitute professional tax or financial advice. Tax laws and program details, including IRS Free File eligibility and income thresholds, may change. Always consult IRS.gov or a certified tax professional for the most current information before filing your 2025 taxes.